California Competes Tax Credit Application Windows Announced

The California Competes Tax Credit (CCTC) is an income tax credit available to businesses that are looking to locate in California or expand their existing operations within the state. It's a competitive program designed to encourage job creation and investment in California.

Eligibility and Application:

Who can apply? Any business, regardless of industry, size, or location, can apply.

How it works: Businesses apply for the credit during specific application periods throughout the year. The application process is competitive and involves two phases:

Phase I (Quantitative Analysis): Applications are initially evaluated based on a cost-benefit ratio, comparing the requested credit amount to the projected employee compensation and capital investment.

Phase II (Qualitative and Quantitative Factors): Applications that are most advantageous to the state move to this phase, where a deeper evaluation considers factors like:

Number of jobs created or retained.

Compensation and benefits paid to employees.

Amount of capital investment.

Strategic importance of the business to the state or region.

Extent of unemployment and poverty in the proposed project area.

Incentives available from other states.

The credit's influence on the business's decision to create new jobs in California.

For 2023-24 fiscal year and beyond, GO-Biz may also consider if the applicant is willing to relocate jobs from a state enacting laws unfavorably affecting discrimination protections based on sexual orientation, gender identity, or expression, or interfering with a woman's right to choose.

Negotiation and Approval: If successful, tax credit agreements are negotiated by the Governor's Office of Business and Economic Development (GO-Biz) and then approved by the California Competes Tax Credit Committee.

Milestones: Businesses commit to meeting yearly milestones for full-time employment, salary levels, and project investment over a five-year agreement period. The credit is earned only if these milestones are met each taxable year.

Benefits:

Income Tax Credit: The CCTC is a non-refundable income tax credit that can reduce a business's state income tax liability.

Carryover: If the credit amount exceeds the tax liability, the unused credit can be carried over for up to six years.

Job Creation and Economic Growth: The program aims to stimulate job creation, increase tax revenues, and foster overall economic growth in California.

Important Notes:

The CCTC is a highly competitive program, with a limited number of companies approved in each application cycle.

Small businesses have a dedicated portion of the total credits available each year.

Failure to meet the agreed-upon milestones can result in the recapture of the credit.

The California Competes Tax Credit is a significant incentive for businesses looking to expand or establish a presence in California, providing a means to offset operational costs through tax savings.

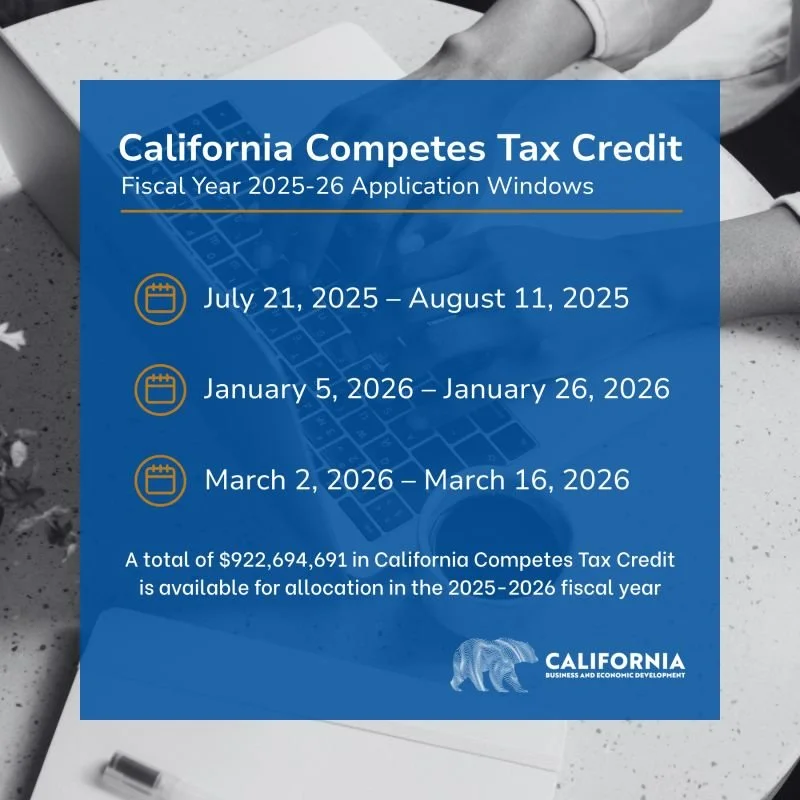

Application Periods: A total of $922,694,691 in California Competes Tax Credit is available for allocation in the 2025-2026 fiscal year. Applications for the California Competes Tax Credit will be accepted online at calcompetes.ca.gov during the following periods:

July 21, 2025, through August 11, 2025 ($308 million in tax credits available)

January 5, 2026, through January 26, 2026 ($308 million in tax credits available)

March 2, 2026, through March 16, 2026 ($306.6 million in tax credits available plus any remaining unallocated amounts from the previous application periods

Businesses interested in learning more about the CCTC may register for a free application webinar on July 23, 2025 | 9:30AM OR July 31, 2025 | 9:30AM for an overview of the program, insight on the evaluation criteria, and step-by-step instructions through the application process.