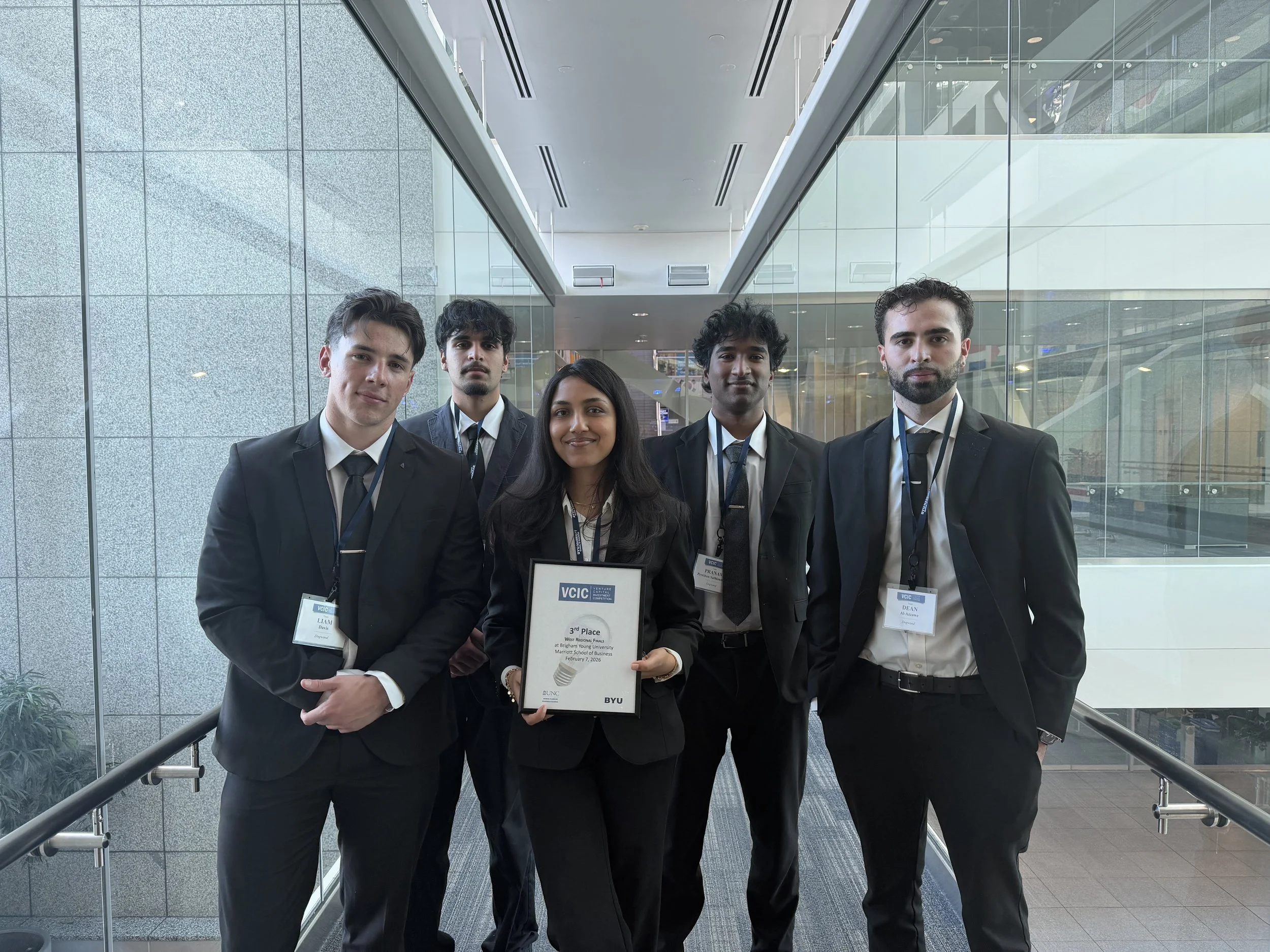

Santa Cruz Students Earn Third Place at 2026 Venture Capital Investment Competition (VCIC) West Regional

By Nada Miljković

University of California, Santa Cruz, Project Manager for CIED

A team of University of California, Santa Cruz students earned third place at the 2026 Venture Capital Investment Competition (VCIC) West Regional, held February 7, 2026, in Provo, Utah — marking the strongest finish in UCSC’s three years competing in the prestigious, invitation-only event.The UCSC VCIC team operates through the UCSC’s Center for Innovation and Entrepreneurial Development (CIED), which supports the competition as part of its broader experiential entrepreneurship programming.Founded in 1979, CIED is the longest-running undergraduate-focused innovation and entrepreneurship center in the United States serving students across all fields of study. Its mission is to develop the entrepreneurial mindset, advanced through a combination of curricular and co-curricular programming, including the Innovation & Entrepreneurship (I&E) Certificate and applied learning opportunities such as competitions. Participation in VCIC represents a recent expansion of that work, extending beyond venture creation to include formal training in venture evaluation.Over the past four years, that mindset-driven approach has evolved to include training students not only to build ventures but to assess them as investors, developing the analytical rigor and investment literacy required for venture decision-making.This year’s result reflects the early emergence of that investment training pipeline. What follows is the story of how UCSC entered the competition, how the team was trained, and how VCIC is becoming part of a broader venture education pathway at UCSC through CIED.Hosted by Brigham Young University, the West Regional brought together leading undergraduate teams from across the region, including the University of Southern California, which secured first place for the third consecutive year. Other competitors included the University of Colorado Boulder, California State University, Chico, Utah Valley University, and Gonzaga University.VCIC is the world’s largest venture capital competition and operates very differently from a traditional pitch event. Rather than presenting startup ideas, students step into the role of investors. Over a compressed seventy-two-hour window, teams receive confidential materials on three real early-stage startups and conduct intensive due diligence, analyzing markets, business models, financial projections, and risk factors.At competition, students interview each founding team and are scored on the rigor of their questioning. They must probe assumptions, identify weaknesses, and assess execution exactly as professional investors would. After deliberation, teams select one company to back and present a fully developed investment thesis and term sheet to a panel of active venture capitalists.In the final round, venture capitalists challenge every assumption in the proposed investment by pressing students to defend not only their conclusions but the analytical reasoning behind them. The discipline mirrors real-world investment committee processes and offers students a rare, unfiltered look into how venture capital decisions are made under pressure.

How It Started

Four years ago, UCSC was not on the VCIC radar — and VCIC was not on ours.The competition was first brought to my attention by UCSC student Rian Borah, now a graduate preparing for graduate school, who approached me with the idea of applying. At the time, we did not fully appreciate how selective and competitive the process was. But we applied and, to our surprise, were accepted. We were grateful simply for the opportunity to participate.Four years later, that initial leap of faith culminated in UCSC’s strongest performance yet in one of the most demanding undergraduate venture capital competitions in the country.This progress would not have been possible without institutional support. The UCSC Foundation Board played a pivotal role through a generous gift that enabled the team to travel and compete without financial barriers. The Innovation and Business Engagement Hub has also contributed funding each year UCSC has participated, reinforcing the university’s sustained commitment to experiential entrepreneurship education.

Building the Structure

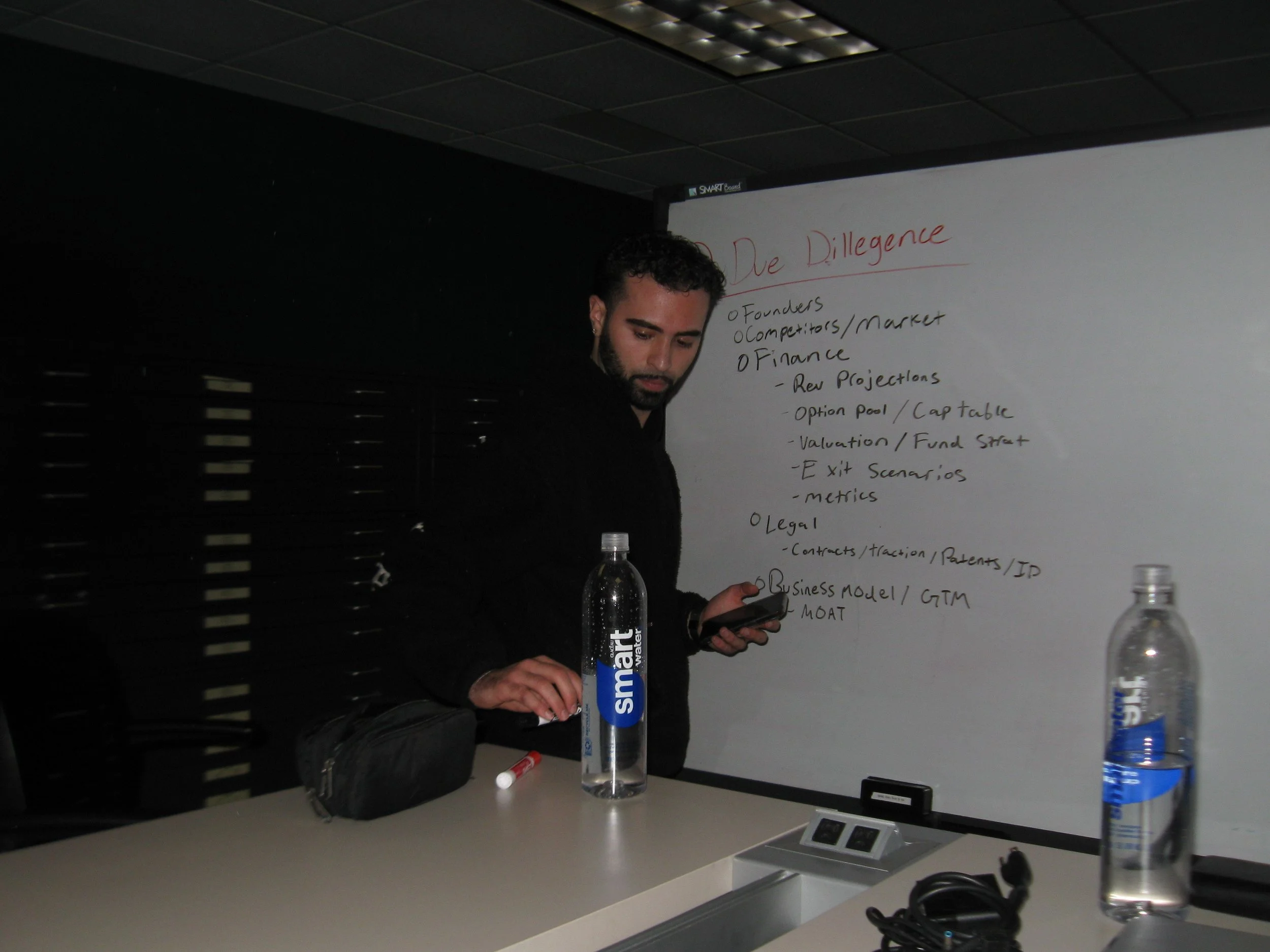

Presentation matters in VCIC. Analytical depth is foundational, but the ability to communicate conviction and composure under pressure often separates top-performing teams. Many universities support their teams through year-round training pipelines and professional coaching.Led by student initiative and leadership, this year marked a significant step toward building that kind of institutional structure at UC Santa Cruz. More than 250 students applied to join the VCIC team. The final ten-student investment group was selected through a rigorous two-stage interview and live case evaluation process designed by student co-leads Liam Davis and Dean Azzawe.The team conducted structured practice sessions, including a full mock trial presentation with Sri Rao, a Silicon Valley venture capitalist and serial entrepreneur and Alexander Sevastopoulos of Santa Cruz Ventures. In that session, students defended their investment thesis under real-time scrutiny, ultimately determining the five-member competition team.The selected team traveled to Utah in advance of the competition, allowing time to prepare before case materials were released. Once the confidential packets were distributed, they had seventy-two hours to complete due diligence before entering formal interviews and final presentations.Five students ultimately represented UCSC in Utah, where their third-place finish reflected not only individual talent, but the emergence of a repeatable training system designed to strengthen performance year over year.The selected team traveled to Utah in advance of the competition, allowing time to prepare before case materials were released. Once the confidential packets were distributed, they had seventy-two hours to complete due diligence before entering formal interviews and final presentations.Five students ultimately represented UCSC in Utah, where their third-place finish reflected not only individual talent, but the early emergence of the investment training pipeline now taking shape at UCSC through CIED, a repeatable system designed to strengthen performance year over year.

Perspective from the Field

Shruti Kale, the first UCSC student to compete in two VCIC competitions, gained a unique perspective on how other institutions approach venture training.“Competing twice gave me perspective,” Kale reflected. “Some universities train year-round. What excites me is that we’re now building that structure at UCSC. We’re proving we can compete at that level. And we are just getting started.”Former team member Ishaan Bansal, who competed on UCSC’s first VCIC team and now works at a startup, described the experience as clarifying.“I now know I don’t want to become a venture capitalist. But as someone who wants to build startups, understanding how VCs think is incredibly important.”Learning to think like an investor fundamentally reshapes how founders approach their own ventures.

The UCSC Team

The five students who competed in Utah were:Liam Davis, Co-LeadDean Azzawe, Co-LeadShruti KalePranav Preethan SathianathanSiddarth ProthiaThey were supported by a broader student investment team that trained throughout the winter in preparation for the competition, including:Charan Rameshkumar Elias Lieser Kevon Baha Laurena Chen Kenneth Vuong Arjun AroraTogether, the team built a culture of rigor, accountability, and shared responsibility that mirrored the dynamics of a real investment committee.“When we were asked to co-lead UCSC’s team, venture capital was new territory for almost all of us,” said Liam Davis. “What began as a steep learning curve became an incredible hands-on experience. Ten students who had never worked in venture capital now know how to evaluate startups and defend real investment decisions.”“What I’m most proud of is the rigor our team built,” added Dean Azzawe. “In seventy-two hours, we turned due diligence into disciplined valuation and a term sheet we could defend under pressure. This third-place finish shows UCSC students can compete at the highest level, and it sets the groundwork for building an even stronger, repeatable program in the years ahead.”

Building the Pipeline

The VCIC program operates through the Center for Innovation and Entrepreneurial Development (CIED) as part of UCSC’s broader experiential entrepreneurship framework.Beginning next fall, Sri Rao will co-teach with me Crown 152: Startup Deal Sourcing and Investing — The Art of Picking Winners. This new course formalizes the analytical frameworks students have been developing through VCIC, creating continuity and a structured feeder pathway for future teams.Rather than rebuilding from scratch each year, the goal is institutional memory: structured investment education, disciplined team formation, and stronger results year over year.UCSC may be newer to the venture competition landscape than some peers, but it is building deliberately and quickly. This third-place finish represents an important milestone in the development of a sustainable venture capital training pipeline designed to endure.

About the Center for Innovation and Entrepreneurial Development (CIED)

CIED at the University of California, Santa Cruz prepares students to think and act entrepreneurially through experiential, interdisciplinary, and community-engaged learning. CIED connects students to real-world challenges across industries and sectors, advancing innovation, economic development, and meaningful social impact locally and globally.Through courses, competitions, mentorship, and applied consulting programs such as GetVirtual, CIED equips students with the skills and professional experience needed to succeed in dynamic, innovation-driven environments.